2024.07.05

Budapest, July 4, 2024 – The “Europe-China Tourism Dialogue” successfully held in Budapest saw the release of the “Cross-Border Tourism Consumption Trends Report 2023-2024” (hereinafter referred to as the “Report”). This is the first time the World Tourism Alliance (WTA), Mastercard, Trip.com Group, and Ant Group have collaborated to observe and analyze cross-border tourism consumption trends from the perspectives of outbound destination markets, inbound source markets, and the overall cross-border tourism industry, providing recommendations for further recovery and sustainable, resilient development of global tourism.

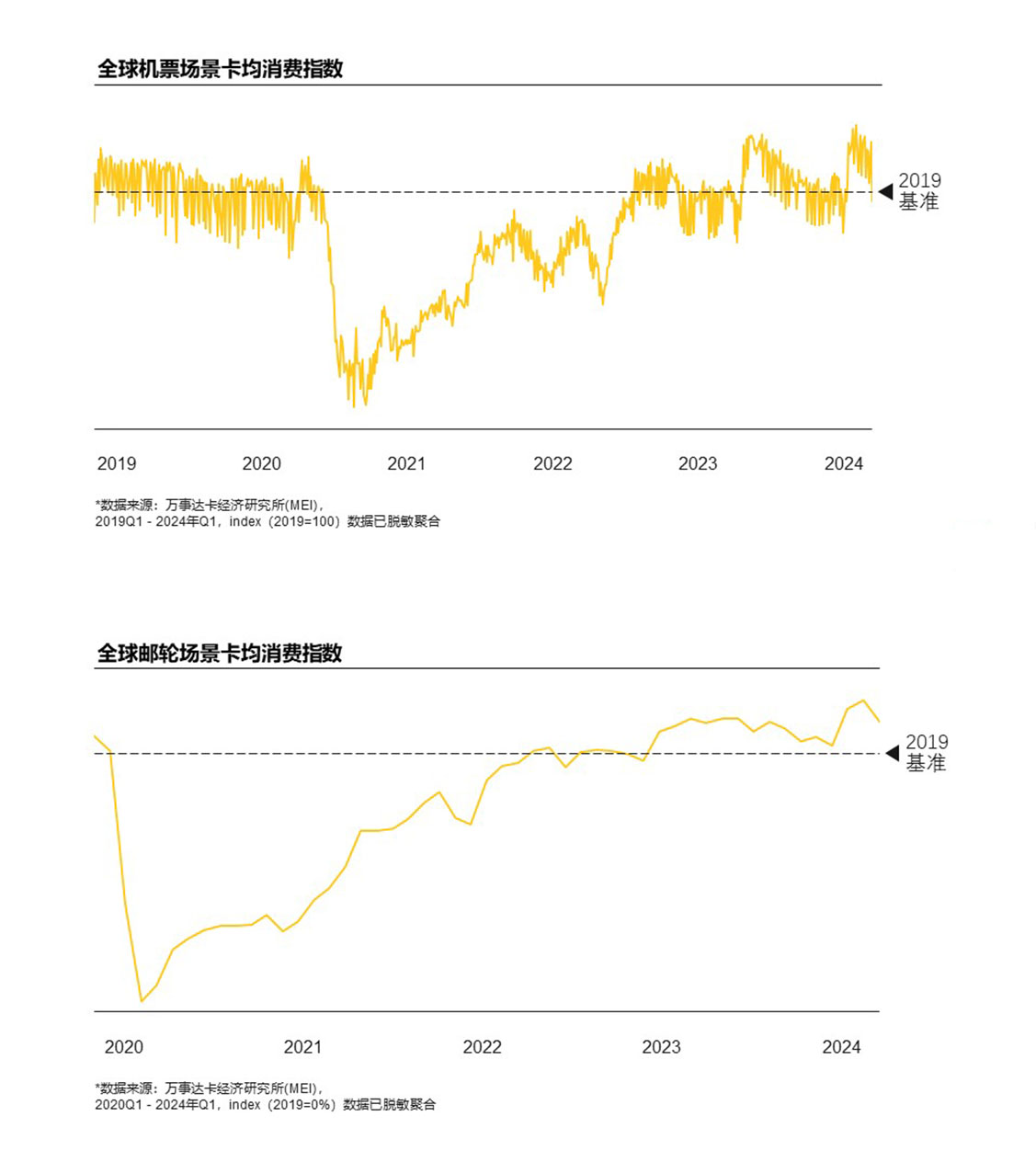

The Report indicates that in 2023-2024, as the global tourism industry experiences a robust recovery, cross-border travel numbers and expenditures have significantly increased, presenting new changes and trends in market structure, supply-demand relationships, and consumer habits. In the first quarter of 2024, the global airline and cruise consumption indices surpassed pre-pandemic levels, with cruise transactions 16% higher than the same period in 2019. The average duration of cross-border stays globally increased by one day compared to pre-pandemic levels, with notable increases in regions such as the Middle East, Africa, and Europe, where stays extended by an average of 2.9 days. In the Asia-Pacific region, the average leisure trip duration increased from 6.1 days pre-pandemic to 7.4 days, boosting single-trip spending and local tourism economies.

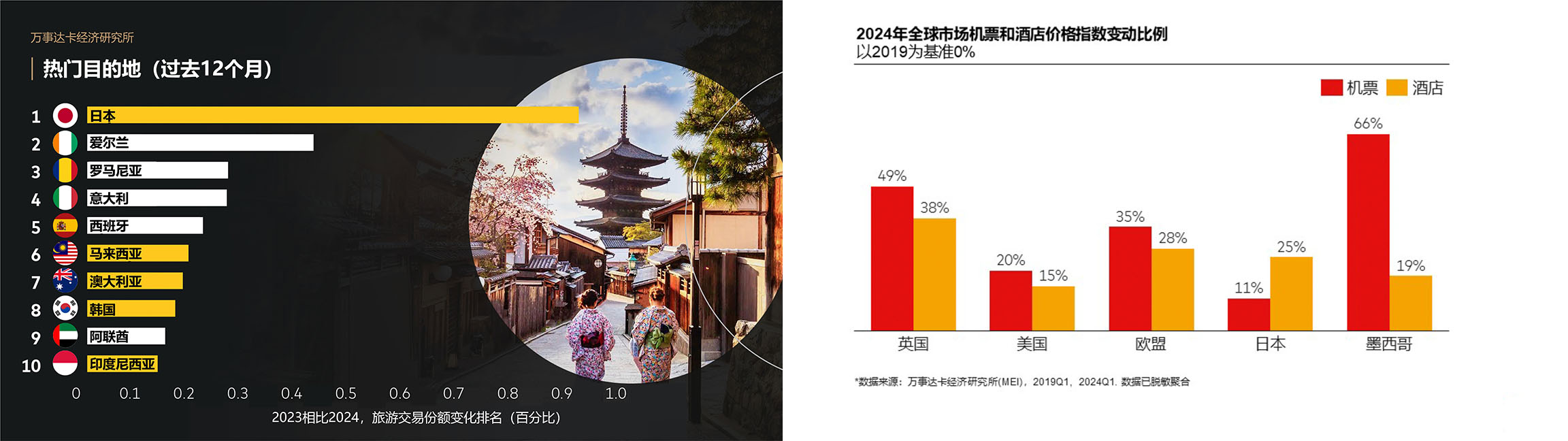

The Asia-Pacific region has become a hot spot for global tourists in 2024, thanks to affordable air tickets, hotels, and travel products, along with a growing middle class and increasing cross-border travel demand. Among the ten fastest-growing global destinations, half are in the Asia-Pacific region, with Japan leading the pack, welcoming a record 3,081,600 international visitors in March 2024.

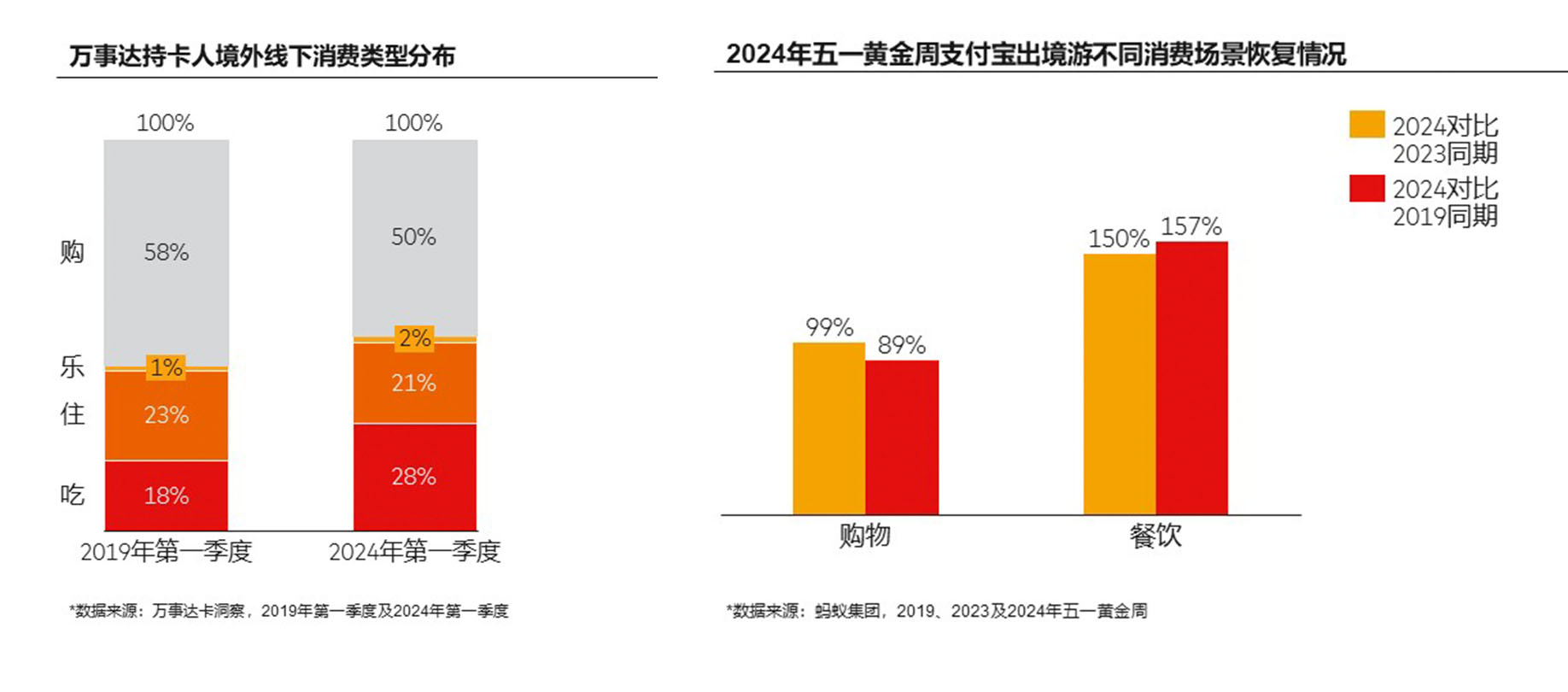

Post-pandemic, tourists’ consumption habits have shifted. They now prioritize unique and memorable experiences. The resumption of major cultural and sporting events has driven more people to travel internationally to attend these events, stimulating the tourism economies of host countries and surrounding areas. For example, the UEFA European Football Championship has made Munich, Germany, the top cross-border destination from June to August 2024. Additionally, during Taylor Swift’s concert, restaurant sales within a 4 km radius increased by 68% compared to regular days. Moreover, cross-border tourists are getting younger and value affordability, relaxation, and local experiences. Affordable dining options saw faster growth in consumption than high-end restaurants in over 90% of destination markets. In retail, cost-effective casual fashion brands dominated the incremental market.

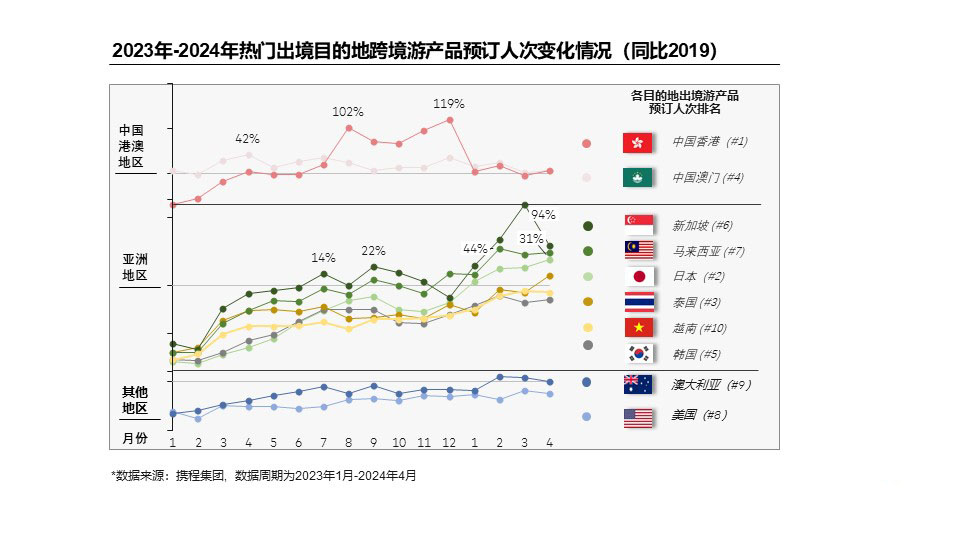

Focusing on the Chinese market, outbound travel consumption is steadily recovering as travel demand releases and international flights resume, with outbound travel numbers gradually increasing and per capita spending significantly rising. Destination choices are evolving from nearby to farther regions. Initially, Macau and Hong Kong experienced rapid recovery, attracting most outbound tourists. As travel to nearby destinations became more convenient, tourists began to visit Southeast Asia, Japan, and other markets, approaching pre-pandemic levels and continuing to thrive. Emerging destinations like the UAE are attracting a large number of business and leisure travelers thanks to visa-free and duty-free policies, leading the global recovery pace.

Booking periods for flights and hotels have significantly shortened compared to pre-pandemic times. The proportion of short- and long-haul travelers booking tickets 30 days or more in advance dropped by over 7%. Per capita spending on flights and hotels increased by 50% and 14%, respectively. Tourists are more focused on quality and experience, preferring high-quality star-rated hotels. In 2023, about 73% of tourists chose four-star and above hotels, slightly higher than in 2019. The share of shopping expenses in outbound travel spending decreased from 58% to 50%, while dining expenses rose from 18% to 28%.

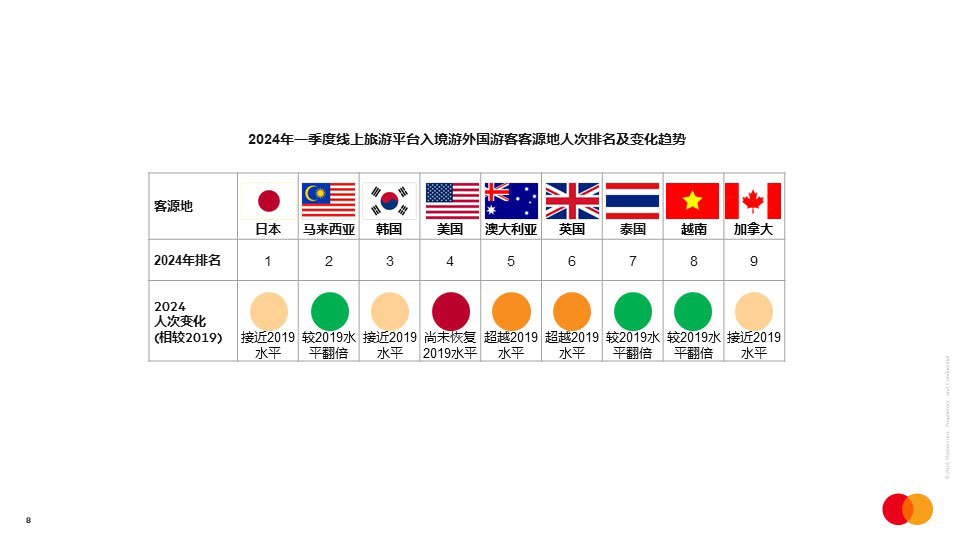

On the inbound side, the continuous expansion of unilateral visa-free policy (as of June 2024, China announced trial visa-free policies for 15 countries), further implementation of transit visa-free policies, comprehensive optimization of visa policies, and ongoing introduction of payment facilitation measures have significantly increased the willingness of overseas tourists to visit China. In the first quarter of 2024, the main source countries for inbound travel on the Trip.com online platform were Japan, Malaysia, South Korea, the United States, Australia, the United Kingdom, Thailand, Vietnam, and Canada. Southeast Asia, particularly Thailand, Singapore, and Malaysia, saw a surge in visitors to China. The European travel market to China also showed a strong recovery, with the number of visitors from France, Spain, and Italy increasing about fourfold from January to April 2024 compared to the same period in 2023.

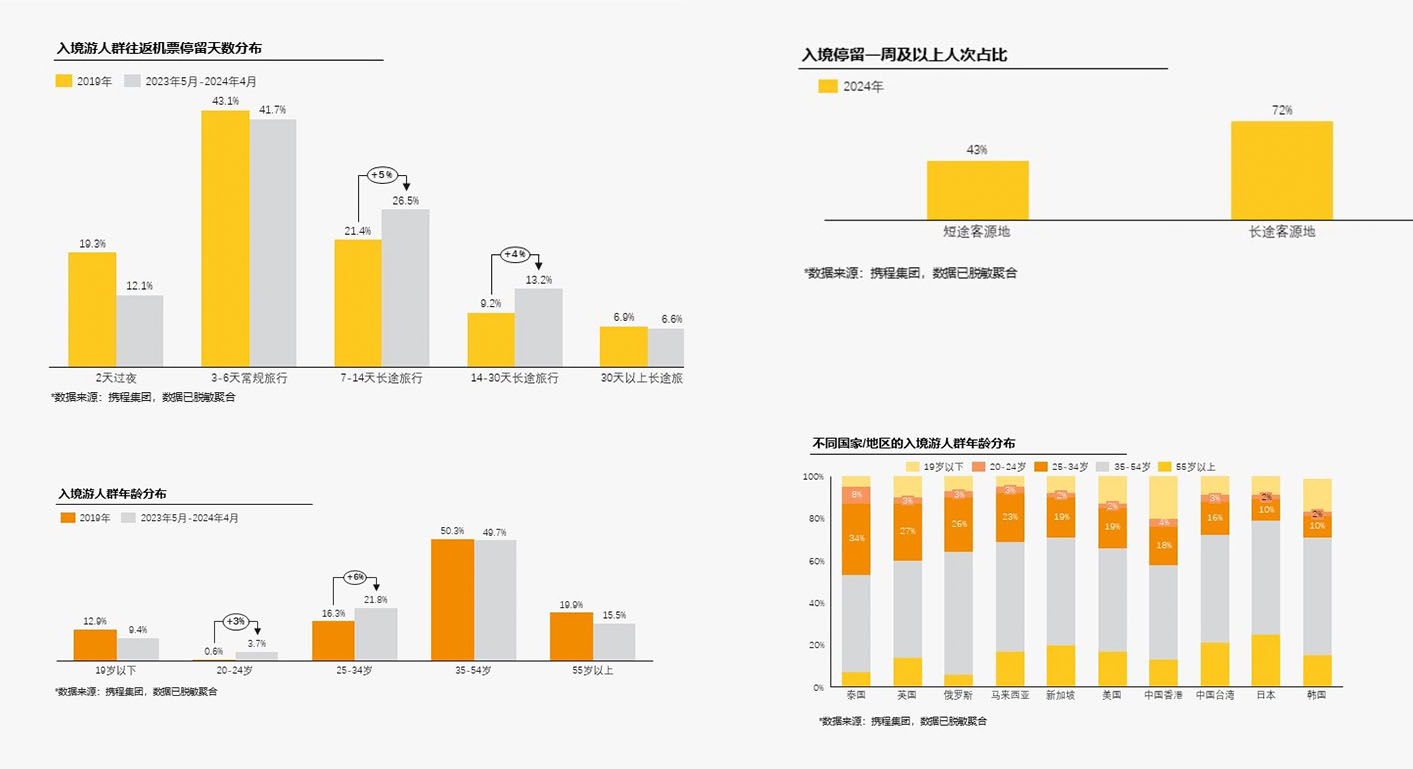

In 2023 and 2024, the proportion of tourists staying in China for more than a week increased significantly compared to 2019, regardless of whether they came from short-haul markets in Asia or long-haul markets in Europe, the Americas, and Oceania. Nearly half of the inbound tourists were aged 35-54, but the proportion of younger tourists aged 20-35 also increased by 9% compared to 2019.

In terms of destination choices, inbound tourists are increasingly exploring deeper into China mainland and popular internet-famous cities. In April 2024, besides traditional first-tier cities like Beijing, Shanghai, Guangzhou, and Shenzhen, destinations like Hangzhou, Chengdu, Xiamen, Chongqing, Suzhou, and Xi’an performed well. In the top fifteen inbound cities, Sichuan and Chongqing regions saw their rankings rise, with Chongqing climbing five places. As the proportion of young inbound tourists increased, the visits to popular internet-famous cities also rose.

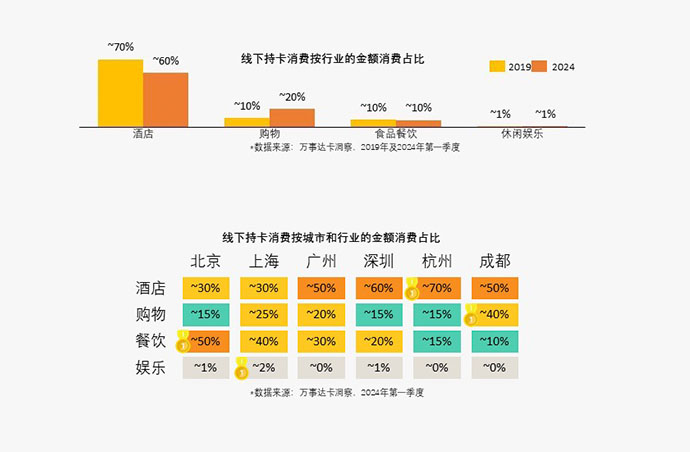

Inbound tourism spending in 2024 shows a richer variety of categories, especially in shopping. Consumption patterns vary by city; for example, shopping accounts for about 30% of inbound spending in Chengdu, leisure and entertainment spending is significant in Shanghai, hotel spending is concentrated in Hangzhou, and dining spending is higher in Beijing.

Payment facilitation is a key initiative for developing inbound tourism in China. Domestic e-wallets have collaborated with international card organizations to introduce payment methods for foreign bank cards, resulting in rapid growth in cross-border transactions. Inbound tourists are using mobile payments in more diverse scenarios, including using apps like “DiDi” and “12306” for transportation and ticket booking, “Meituan” for food delivery, and even “Xiaohongshu” for live-stream shopping.

The Report also analyzed popular outbound destinations such as Thailand and Italy and inbound destinations like Harbin and Zhangjiajie, providing suggestions for promoting cross-border tourism development. Strengthening overseas promotion of tourism resources, simplifying visa processes, increasing flight numbers supplemented by air-rail intermodal transport, optimizing identity verification and reservation systems, enhancing foreign language tourism information and signage, and training foreign language talents, as well as introducing payment facilitation measures for inbound tourists, will help further revive China’s inbound tourism market. As the largest source country for cross-border tourism, destination countries are suggested to continuously optimize visa policies for Chinese tourists, improve the supply of Chinese tourism information, upgrade tourism products and services, and enhance the convenience and safety of overseas payments to further unleash the potential of China’s outbound tourism market.

The rapid development of the tourism industry brings significant economic growth but can also impact ecological environments and cultural heritage. Sustainable tourism development is a critical issue facing countries worldwide. The Report shares successful case studies, offering insights and strategies for destinations globally. By leveraging the efforts of governments, enterprises, and communities, implementing environmental protection measures, supporting community development, and investing in infrastructure, the tourism industry can achieve mutual benefits and drive sustainable development.

The full text of the “Cross-Border Tourism Consumption Trends Report 2023-2024” is available on the World Tourism Alliance’s official website.